|

|

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| SCHEDULE 14A INFORMATION |

| Proxy Statement Pursuant to Section 14(a) of the |

Securities Exchange Act of 1934 (Amendment No. ) |

Filed by the Registrant x Filed by a party other than the Registrant ¨

Check the appropriate box:

| |

| ¨ | Preliminary Proxy Statement |

| |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | Definitive Proxy Statement |

| |

| ¨ | Definitive Additional Materials |

| |

| ¨ | Soliciting Material under § 240.14a-12 |

Fitbit, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than Thethe Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

| |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

| |

| ¨ | Fee paid previously with preliminary materials. |

| |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

| |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

April 13, 201711, 2019

To Our Stockholders:

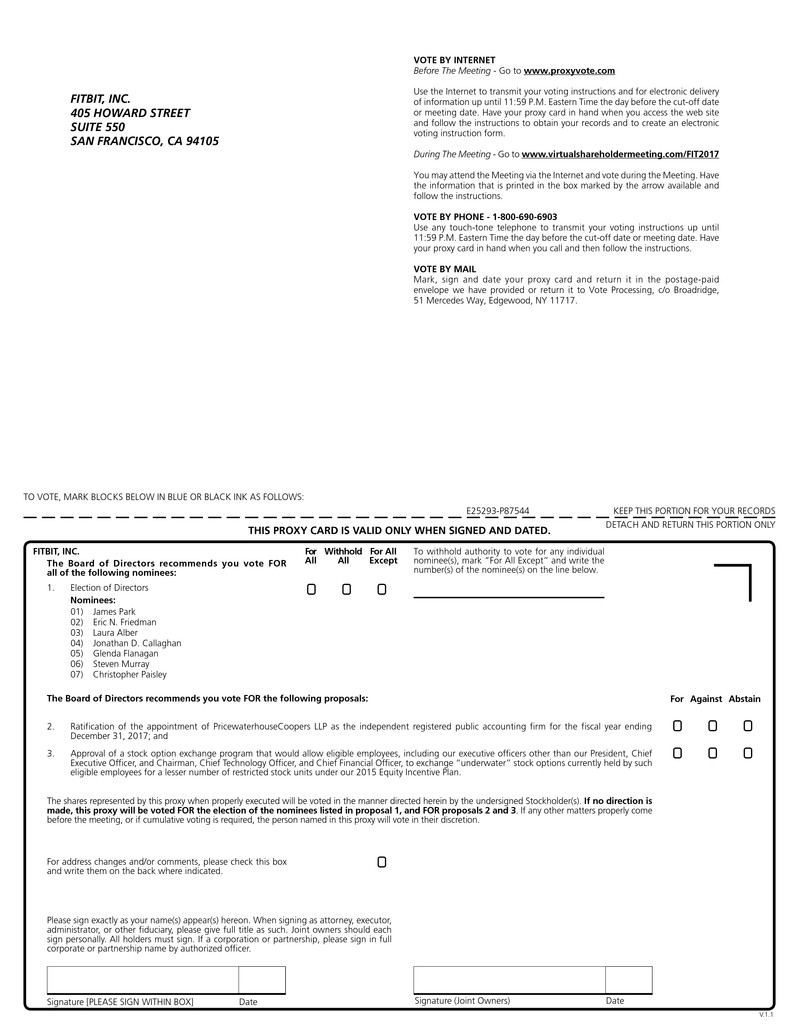

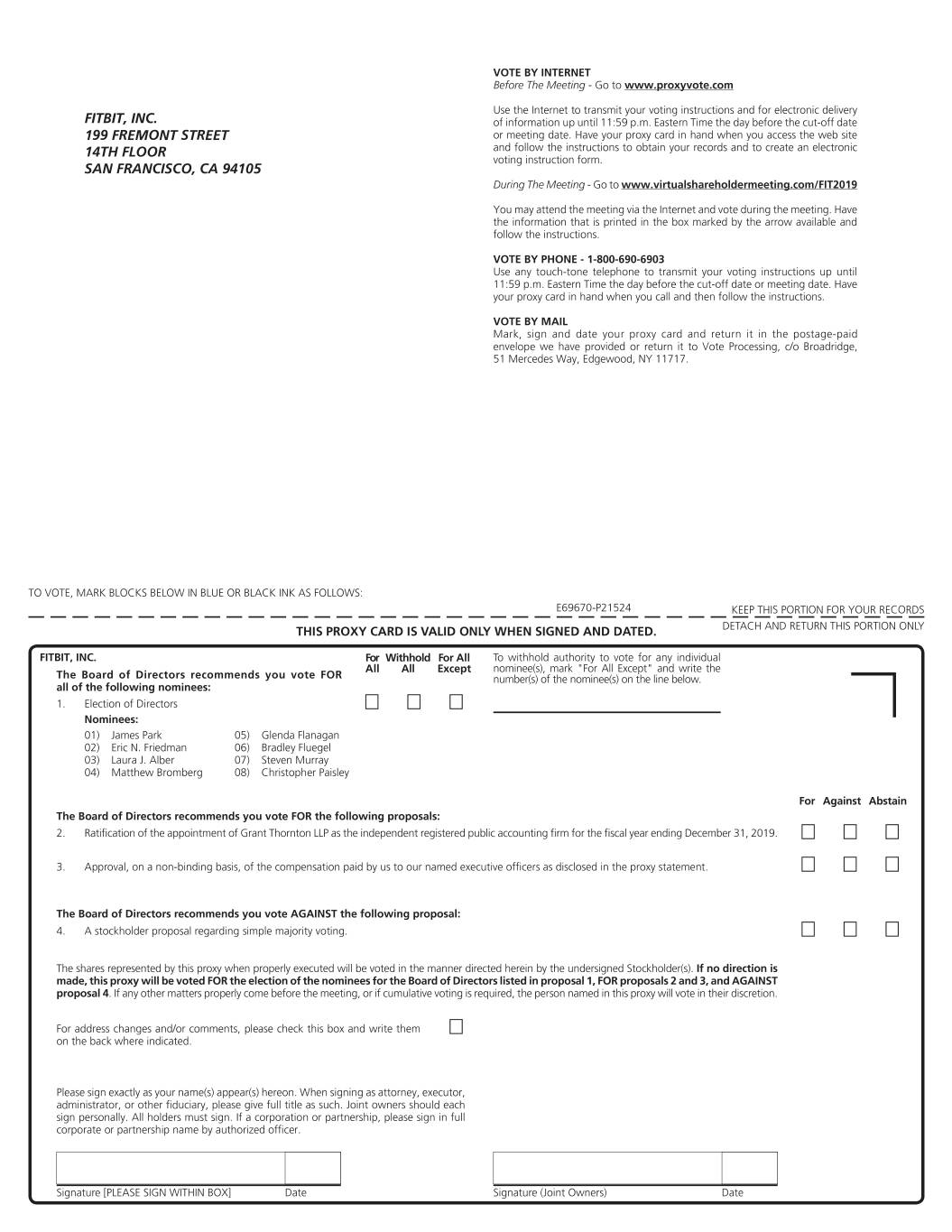

You are cordially invited to attend the 20172019 Annual Meeting of Stockholders, or Annual Meeting, of Fitbit, Inc., which will be held virtually on Thursday, May 25, 2017,23, 2019, at 11:00 a.m. (Pacific Time). The Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/FIT2017,FIT2019, where you will be able to listen to the meeting live, submit questions, and vote online. We believe that a virtual stockholder meeting provides greater access to those who may want to attend and therefore have chosen this over an in person meeting.

The matters expected to be acted upon at the Annual Meeting are described in detail in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.proxy statement.

Your vote is important. Whether or not you plan to attend the meeting, please cast your vote as soon as possible by Internet or telephone, or by completing and returning the enclosed proxy card in the postage-prepaid envelope to ensure that your shares will be represented. Your vote by written proxy will ensure your representation at the Annual Meeting regardless of whether you attend the virtual meeting or not. Returning the proxy does not deprive you of your right to attend the meeting and to vote your shares at the virtual meeting.

We look forward to your attendance at our Annual Meeting.

Sincerely,

James Park

President, Chief Executive Officer, and Chairman

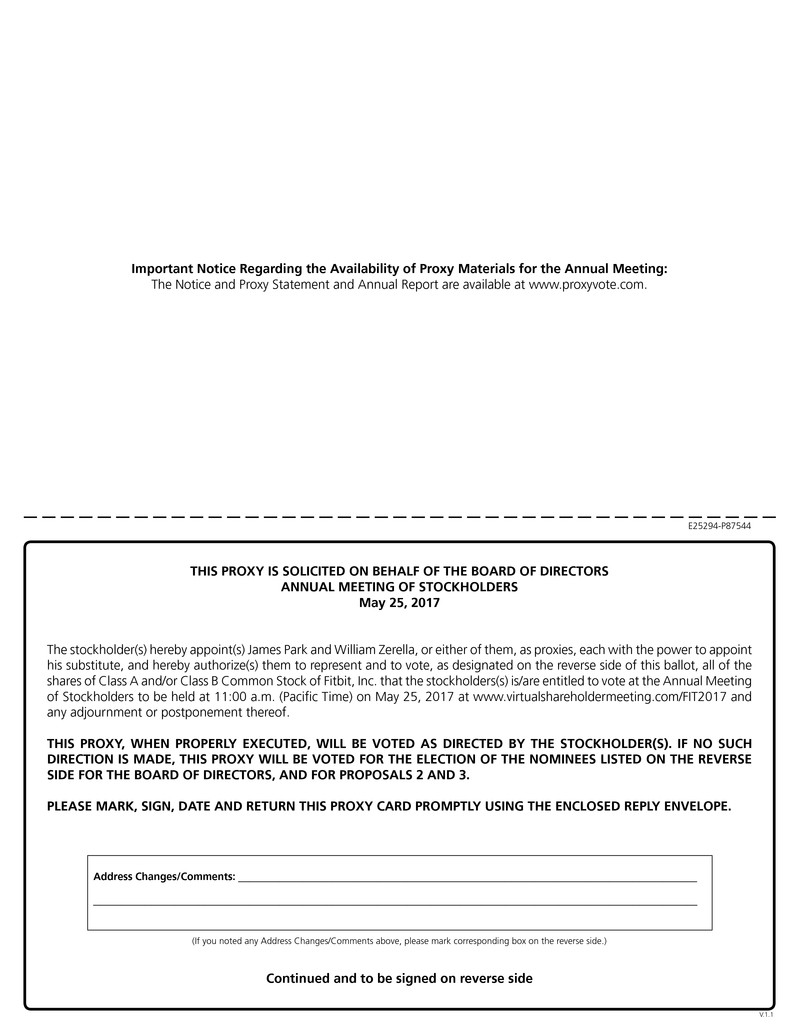

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE STOCKHOLDER MEETING TO BE HELD ON MAY 25, 2017:23, 2019:

THIS PROXY STATEMENT AND THE ANNUAL REPORT ARE AVAILABLE AT

www.proxyvote.com

|

|

| FITBIT, INC. |

405 Howard199 Fremont Street, 14th Floor |

| San Francisco, California 94105 |

| |

| NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

| |

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the 20172019 Annual Meeting of Stockholders, or Annual Meeting, of Fitbit, Inc. will be held virtually on Thursday, May 25, 2017,23, 2019, at 11:00 a.m. (Pacific Time). The Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/FIT2017,FIT2019, where you will be able to listen to the meeting live, submit questions, and vote online.

We are holding the meetingAnnual Meeting for the following purposes, which are more fully described in the accompanying proxy statement:

1. To elect seveneight directors, all of whom are currently serving on our board of directors, each to serve until the next annual meeting of stockholders and until his or her successor has been elected and qualified, or until his or her earlier death, resignation, or removal.

James Park

Eric N. Friedman

Laura J. Alber

Jonathan D. CallaghanMatthew Bromberg

Glenda Flanagan

Bradley Fluegel

Steven Murray

Christopher Paisley

2. To ratify the appointment of PricewaterhouseCoopersGrant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017.2019.

3. To approvehold a stock option exchange program that would allow eligible employees, includingnon-binding advisory vote on the compensation paid by us to our named executive officers other than our President, Chief Executive Officer,as disclosed in this proxy statement.

4. To consider and Chairman, Chief Technology Officer, and Chief Financial Officer, to exchange “underwater” stock options currently held by such eligible employees for a lesser number of new restricted stock units, or RSUs, under our 2015 Equity Incentive Plan, or 2015 Plan.vote upon one stockholder proposal, if properly presented.

In addition, stockholders may be asked to consider and vote upon such other business as may properly come before the meetingAnnual Meeting or any adjournment or postponement thereof.

Only stockholders of record at the close of business on March 28, 201726, 2019 are entitled to notice of, and to vote at, the Annual Meeting and any adjournments thereof.

Your vote as a Fitbit stockholder is very important. Each share of Class A common stock that you own represents one vote and each share of Class B common stock that you own represents ten votes. For questions regarding your stock ownership, you may contact us through our website at http:https://investor.fitbit.com/investor.fitbit.com or, if you are a registered holder, our transfer agent, Computershare Trust Company, N.A., by calling (877) 373-6374 (toll-free) or (781) 575-3100, by writing to P.O. BOX 30170 College Station, TX 77842 (by regular mail) or 211 Quality Circle Suite 210 College Station, TX 77845 (by overnight delivery) or by visiting their website at www.computershare.com/investor.

By Order of the Board of Directors,

By Order of the Board of Directors,

James Park

President, Chief Executive Officer, and Chairman

San Francisco, California

April 13, 201711, 2019

|

|

| |

| YOUR VOTE IS IMPORTANT |

| |

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, WE ENCOURAGE YOU TO VOTE AND SUBMIT YOUR PROXY BY INTERNET, TELEPHONE, OR BY MAIL. FOR ADDITIONAL INSTRUCTIONS ON VOTING BY TELEPHONE OR THE INTERNET, PLEASE REFER TO YOUR PROXY CARD. TO VOTE AND SUBMIT YOUR PROXY BY MAIL, PLEASE COMPLETE, SIGN, AND DATE THE ENCLOSED PROXY CARD AND RETURN IT IN THE ENCLOSED ENVELOPE. IF YOU ATTEND THE ANNUAL MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE VIA THE VIRTUAL MEETING WEBSITE. IF YOU HOLD YOUR SHARES THROUGH AN ACCOUNT WITH A BROKERAGE FIRM, BANK, OR OTHER NOMINEE, PLEASE FOLLOW THE INSTRUCTIONS YOU RECEIVE FROM YOUR ACCOUNT MANAGER TO VOTE YOUR SHARES.

|

|

|

| |

| FITBIT, INC. |

PROXY STATEMENT FOR 20172019 ANNUAL MEETING OF STOCKHOLDERS |

| |

| Table of Contents |

April 13, 201711, 2019

|

|

| FITBIT, INC. |

405 Howard199 Fremont Street, 14th Floor |

| San Francisco, California 94105 |

| |

PROXY STATEMENT FOR THE 20172019 ANNUAL MEETING OF STOCKHOLDERS |

| |

INFORMATION ABOUT SOLICITATION AND VOTING

The accompanying proxy is solicited on behalf of the board of directors of Fitbit, Inc. for use at our 20172019 Annual Meeting of Stockholders, or Annual Meeting, to be held virtually on May 25, 2017,23, 2019, at 11:00 a.m. (Pacific Time), and any adjournment or postponement thereof. The Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/FIT2017,FIT2019, where you will be able to listen to the meeting live, submit questions, and vote online. The Notice of Internet Availability of Proxy Materials and this proxy statement for the Annual Meeting, or Proxy Statement, and the accompanying form of proxy were first distributed and made available on the Internet to stockholders on or about April 13, 2017.11, 2019. An annual report on Form 10-K for the fiscal year ended December 31, 20162018 is available with this Proxy Statement by following the instructions in the Notice of Internet Availability of Proxy Materials.

INTERNET AVAILABILITY OF PROXY MATERIALS

In accordance with U.S. Securities and Exchange Commission, or SEC, rules, we are using the Internet as our primary means of furnishing proxy materials to stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send these stockholders a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials, including our Proxy Statement and annual report on Form 10-K, and voting via the Internet. The Notice of Internet Availability of Proxy Materials also provides information on how stockholders may obtain paper copies of our proxy materials if they so choose. We believe this rule makes the proxy distribution process more efficient, less costly, and helps in conserving natural resources.

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

Purpose of the Annual Meeting

At the Annual Meeting, stockholders will act upon the proposals described in this Proxy Statement.

Record Date; Quorum

Only holders of record of our Class A common stock and Class B common stock at the close of business on March 28, 2017,26, 2019, or the Record Date, will be entitled to vote at the Annual Meeting. At the close of business on the Record Date, we had 184,883,569223,455,707 shares of Class A common stock and 43,378,74831,267,322 shares of Class B common stock outstanding and entitled to vote.

The holders of a majority of the voting power of the shares of our Class A common stock and Class B common stock (voting together as a single class) entitled to vote at the Annual Meeting as of the Record Date must be present at the Annual Meeting in order to hold the Annual Meeting and conduct business. This presence is called a quorum. Your shares are counted as present at the Annual Meeting if you are present and vote online at the Annual Meeting or if you have properly submitted a proxy.

Voting Rights; Required Vote

In deciding all matters at the Annual Meeting, as of the close of business on the Record Date, each share of Class A common stock that you own represents one vote and each share of Class B common stock that you own represents ten votes. We do not have cumulative voting rights for the election of directors. You may vote all shares owned by you as of the Record Date, including (i) shares held directly in your name as the stockholder of record and (ii) shares held for you as the beneficial owner in street name through a broker, bank, trustee, or other nominee.

Stockholder of Record: Shares Registered in Your Name. If, on the Record Date, your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are considered the stockholder of record with respect to those shares. As a stockholder of record, you may vote at the Annual Meeting or vote by telephone, by Internet, or by filling out and returning the proxy card.

Beneficial Owner: Shares Registered in the Name of a Broker or Nominee. If, on the Record Date, your shares were held in an account with a brokerage firm, bank, or other nominee, then you are the beneficial owner of the shares held in street name. As a beneficial owner, you have the right to direct your nominee on how to vote the shares held in your account, and your nominee has enclosed or provided voting instructions for you to use in directing it on how to vote your shares. However, the organization that holds your shares is considered the stockholder of record for purposes of voting at the Annual Meeting. Because you are not the stockholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a valid proxy from the organization that holds your shares giving you the right to vote the shares at the Annual Meeting.

Each director will be elected by a plurality of the votes cast, which means that the seveneight individuals nominated for election to the board of directors at the Annual Meeting receiving the highest number of “FOR” votes will be elected. You may either vote “FOR” one or any of the nominees or “WITHHOLD” your vote with respect to one or any of the nominees. With respect to (i) the (i) ratification of PricewaterhouseCoopersGrant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017, and2019, (ii) approval of the stock option exchange program for eligible employees, includingnon-binding advisory vote on the Compensation Program of our named executive officers, other than our President, Chief Executive Officer,or Compensation Program, and Chairman, Chief Technology Officer, and Chief Financial Officer,(iii) approval of the stockholder proposal regarding majority voting, approval will be obtained if the number of votes cast “FOR” the proposalsproposal at the Annual Meeting exceeds the number of votes cast “AGAINST” the proposals.proposal. If you elect to abstain from voting on these proposals, the abstention will not have any effect on the vote.

Broker non-votes occur when shares held by a broker for a beneficial owner are not voted either because (i) the broker did not receive voting instructions from the beneficial owner, or (ii) the broker lacked discretionary authority to vote the shares. Abstentions occur when shares present at the Annual Meeting are marked “abstain.” A broker is entitled to vote shares held for a beneficial owner on “routine” matters without instructions from the beneficial owner of those shares. Absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on “non-routine” matters. At our Annual Meeting, only the ratification of PricewaterhouseCoopersGrant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017,2019, is considered a routine matter. The other proposals presented at the Annual Meeting are non-routine matters. Broker non-votes and abstentions are counted for purposes of determining whether a quorum is present, but have no effect on the outcome of the matters voted upon. Accordingly, we encourage you to provide voting instructions to your broker, whether or not you plan to attend the Annual Meeting.

Recommendations of the Board of Directors on Each of the Proposals Scheduled to be Voted on at the Annual Meeting

The board of directors recommends that you vote “FOR” (i) each of the directors named in this Proxy Statement, or Proposal 1, (ii)“FOR” the ratification of the appointment of PricewaterhouseCoopersGrant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017,2019, or Proposal 2, and (iii)“FOR” the stock option exchange program for eligible employees, including our executive officers other than our President, Chief Executive Officer, and Chairman, Chief Technology Officer, and Chief Financial Officer,approval, on a non-binding advisory basis, of the Compensation Program, or Proposal 3. None

The board of our directors recommends that you vote “AGAINST” the stockholder proposal regarding majority voting, or executive officers has any substantial interest in any matter to be acted upon, other than (i) our directors, with respect to the elections to office of the directors so nominated and (ii) our executive officers, other than our President, Chief Executive Officer, and Chairman, Chief Technology Officer, and Chief Financial Officer, with respect to the stock option exchange program for eligible employees in which such executive officers are eligible to participate.Proposal 4.

Voting Instructions; Voting of Proxies

If you are a stockholder of record, you may:

vote via the virtual meeting website—website — any stockholder can attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/FIT2017,FIT2019, where stockholders may vote and submit questions during the meeting. The meetingAnnual Meeting starts at 11:00 a.m. (Pacific Time). Please have your 16-Digit Control Number to join the Annual Meeting. Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.proxyvote.com;

vote via telephone or Internet—Internet — in order to do so, please follow the instructions shown on your proxy card; or

vote by mail—mail — complete, sign, and date the proxy card enclosed herewith and return it before the Annual Meeting in the envelope provided.

Votes submitted by telephone or Internet must be received by 11:59 pm Eastern Time on May 24, 2017.22, 2019. Submitting your proxy, whether via the Internet, by telephone, or by mail, will not affect your right to vote in person should you decide to attend the Annual Meeting. If you are not the stockholder of record, please refer to the voting instructions provided by your nominee to direct your nominee on how to vote your shares. You may either vote “FOR” all of the nominees to the board of directors, or you may withhold your vote from all nominees or any nominee you specify. For Proposals 2, 3 and 3,4, you may vote “FOR” or “AGAINST” or “ABSTAIN” from voting. Your vote is important. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure that your vote is counted.

All proxies will be voted in accordance with the instructions specified on the proxy card. If you sign a physical proxy card and return it without instructions as to how your shares should be voted on a particular proposal at the Annual Meeting, your shares will be voted in accordance with the recommendations of our board of directors stated above.

If you do not vote and you hold your shares in street name, and your broker does not have discretionary power to vote your shares, your shares may constitute “broker non-votes” (as described above) and will not be counted in determining the number of shares necessary for approval of the proposals. However, shares that constitute broker non-votes will be counted for the purpose of establishing a quorum for the Annual Meeting.

If you receive more than one proxy card, this is because your shares are registered in more than one name or are registered in different accounts. To make certain all of your shares are voted, please follow the instructions included on each proxy card and vote each proxy card by telephone or the Internet. If voting by mail, please complete, sign, and return each proxy card to ensure that all of your shares are voted.

Expenses of Soliciting Proxies

We will pay the expenses of soliciting proxies. Following the original mailing of the soliciting materials, we and our agents, including directors, officers, and other employees, without additional compensation, may solicit proxies by mail, electronic mail, telephone, facsimile, by other similar means, or in person. Following the original mailing of the soliciting materials, we will request brokers, custodians, nominees, and other record holders to forward copies of the soliciting materials to persons for whom they hold shares and to request authority for the exercise of proxies. In such cases, we, upon the request of the record holders, will reimburse such holders for their reasonable expenses. If you choose to access the proxy materials through the Internet, you are responsible for any Internet access charges you may incur.

Revocability of Proxies

A stockholder who has given a proxy may revoke it at any time before it is exercised at the Annual Meeting by:

delivering to our Corporate Secretary (by any means) a written notice stating that the proxy is revoked;

signing and delivering a proxy bearing a later date;

voting again by telephone or Internet; or

attending and voting at the Annual Meeting (although attendance at the Annual Meeting will not, by itself, revoke a proxy).

Please note, however, that if your shares are held of record by a broker, bank, or other nominee and you wish to revoke a proxy, you must contact that firm to revoke any prior voting instructions.

Voting Results

Voting results will be tabulated and certified by the inspector of elections appointed for the Annual Meeting. The preliminary voting results will be announced at the Annual Meeting. The final results will be tallied by the inspector of elections and filed with the SEC in a current report on Form 8-K within four business days of the Annual Meeting.

BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD;

BOARD, CORPORATE GOVERNANCE STANDARDS, AND DIRECTOR INDEPENDENCE

We are strongly committed to good corporate governance practices. These practices provide an important framework within which our board of directors and management can pursue our strategic objectives for the benefit of our stockholders.

Corporate Governance Guidelines

Our board of directors has adopted corporate governance guidelines, or Corporate Governance Guidelines, that set forth the role of our board of directors, director independence standards, board structure and functions, director selection considerations, and other policies for the governance of the company, or Corporate Governance Guidelines.company. Our Corporate Governance Guidelines are available in the Investor Relations section of our website, which is located at http:https://investor.fitbit.com by clicking on “Governance”.“Governance.” Our nominating and governance committee reviews the Corporate Governance Guidelines periodically and recommends changes to our board of directors as warranted.

Board Leadership Structure

Our Corporate Governance Guidelines provide that our board of directors may choose its chairperson in any way that it considers in the best interests of our company. Our nominating and governance committee periodically considers the leadership structure of our board of directors and makes such recommendations to our board of directors with respect thereto as our nominating and governance committee deems appropriate. Our Corporate Governance Guidelines also provide that, when the positions of chairperson and chief executive officer are held by the same person, the independent directors will designate a “lead independent director.” In cases in which the chairperson and chief executive officer are the same person, the responsibilities of the lead independent director include: presiding over executive sessions of independent directors; serving as a liaison between the chief executive officer and the independent directors; being available, under appropriate circumstances, for consultation and direct communication with stockholders; and performing such other functions and responsibilities as requested by our board of directors from time to time.

Currently, our board of directors believes that it is in the best interest of our company and our stockholders for our President and Chief Executive Officer, Mr. Park, to serve as both President and Chief Executive Officer and Chairman given his knowledge of our company and industry and strategic vision. Because Mr. Park serves in both these roles, our board of directors appointed Jonathan D. Callaghan to serve as our lead independent director. Mr. Callaghan served as lead independent director through the date of our 2018 annual meeting of stockholders, or the 2018 Annual Meeting, where he did not stand for re-election. Our board of directors appointed Steven Murray to serve as our lead independent director following our 2018 Annual Meeting. As lead independent director, Mr. Callaghan,Murray, among the other responsibilities noted above, presides over regularly scheduled meetings at which only our independent directors are present, serves as a liaison between Mr. Park and the independent directors, and performs such additional duties as our board of directors may otherwise determine and delegate. Our board of directors believes that its independence and oversight of management is maintained effectively through this leadership structure, the composition of our board of directors, and sound corporate governance policies and practices.

Our Board of Directors’ Role in Risk Oversight

Our board of directors is primarily responsible for overseeing our risk management processes. Our board of directors, as a whole, determines our appropriate level of risk, assesses the specific risks that we face, and reviews management’s strategies for adequately mitigating and managing the identified risks. Although our board of directors administers this risk management oversight function, the committees of our board of directors support our board of directors in discharging its oversight duties and address risks inherent in their respective areas. The audit committee reviews our major financial risk exposures and the steps management has taken to monitor and control such exposures, including our procedures and related policies with respect to risk assessment and risk management. Our audit committee also reviews matters relating to compliance, cybersecurity, data privacy and security and reports to our board of directors regarding such matters. The compensation committee reviews risks and exposures associated with compensation plans and programs. We believe this division of responsibilities is an effective approach for addressing the risks we face and that our board leadership structure supports this approach.

Director Independence

The listing rules of the New York Stock Exchange generally require that a majority of the members of a listed company’s board of directors be independent. In addition, the listing rules generally require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and governance committees be independent.

In addition, audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or Exchange Act. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee: accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries; or be an affiliated person of the listed company or any of its subsidiaries.

Our board of directors conducts an annual review of the independence of our directors. In its most recent review, our board of directors determined that Messrs. Callaghan,Bromberg, Fluegel, Murray, and Paisley, and Mses. Alber and Flanagan, representing fivesix of our seveneight directors, are “independent directors” as defined under the applicable rules, regulations, and listing standards of the New York Stock Exchange and the applicable rules and regulations promulgated by the SEC. Our board of directors has also determined that all members of our audit committee, compensation committee, and nominating and governance committee are independent and satisfy the relevant SEC and New York Stock Exchange independence requirements for such committees.

Board Committees

Our board of directors has established an audit committee, a compensation committee, and a nominating and governance committee. The composition and responsibilities of each committee are described below. Each of these committees has a written charter approved by our board of directors. Copies of the charters for the audit committee, compensation committee, and nominating and governance committee are available on the Investor Relations section of our website http:which is located at https://investor.fitbit.com.investor.fitbit.com by clicking on “Governance.” Members serve on these committees until their resignations or until otherwise determined by our board of directors.

Audit Committee

Our audit committee is comprised of Mr. Paisley, who is the chair of the audit committee, Ms. Flanagan, and Mr. Murray. Each member of our audit committee is independent under the current New York Stock Exchange and SEC rules and regulations. Each member of our audit committee is financially literate as required by current New York Stock Exchange listing standards. Our board of directors has also determined that simultaneous service by Mr. Paisley on the audit committees of more than three public companies does not impair his ability to serve on our audit committee. In addition, our board of directors has determined that each of Mr. Paisley and Ms. Flanagan is an audit committee financial expert within the meaning of Item 407(d) of Regulation S-K promulgated under the Securities Act of 1933, as amended, or Securities Act. As more fully described in its charter, our audit committee is directly responsible for, among other things:

selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements;

helping to ensure the independence and performance of the independent registered public accounting firm;

discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and the independent accountants, our interim and year-end operating results;

reviewing our policies on risk assessment and risk management;management, including risks related to cybersecurity;

obtaining and reviewing a report by the independent registered public accounting firm at least annually, that describes our internal quality-control procedures, any material issues with such procedures, and any steps taken to deal with such issues;

approving (or, as permitted, pre-approving) all audit and all permissible non-audit services to be performed by the independent registered public accounting firm; and

reviewing related-party transactions and proposed waivers.

Compensation Committee

Our compensation committee is comprised of Mr. Callaghan,Fluegel, who is the chair of the compensation committee (following the 2018 Annual Meeting), Mr. Bromberg and Mr. Murray. Mr. Callaghan served as our chair of the compensation committee through the date of

our 2018 Annual Meeting, Ms. Alber served as a member of the compensation committee until the 2018 Annual Meeting and Mr. Paisley. Paisley served as a member of the compensation committee until October 2018. The composition of our compensation committee meets the requirements for independence under current New York Stock Exchange and SEC rules and regulations. Each member of this committee is also a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act, and an outside director, as defined pursuant to Section 162(m).Act. The purpose of our compensation committee is to discharge the responsibilities of our board of directors relating to compensation of our executive officers. As more fully described in its charter, our compensation committee is responsible for, among other things:

determining and approving, or making recommendations to our board of directors regarding, the compensation of our executive officers;

recommending to our board of directors the compensation of our non-employee directors;

administering our stock and equity incentive plans;

reviewing and approving, or making recommendations to our board of directors regarding, cash-based and equity-based incentive compensation plans; and

reviewing our overall compensation strategy.

Nominating and Governance Committee

The nominating and governance committee is comprised of Mr. Murray,Fluegel, who is the chair of the nominating and governance committee (following the 2018 Annual Meeting), and Ms. Alber (following the 2018 Annual Meeting), and Mr. Callaghan. Paisley (as of March 2019). Mr. Murray served as the chair of our nominating and governance committee until our 2018 Annual Meeting and Mr. Callaghan was a member of our nominating and governance committee until our 2018 Annual Meeting. The composition of our nominating and governance committee meets the requirements for independence under current New York Stock Exchange and SEC rules and regulations. As more fully described in its charter, our nominating and governance committee is responsible for, among other things:

identifying and recommending candidates for membership on our board of directors;

overseeing the process of evaluating the performance of our board of directors and each committee of the board of directors;

considering and making recommendations to our board of directors regarding the composition of our board of directors and its committees;

developing and making recommendations to our board of directors regarding corporate governance guidelines and policies; and

advising our board of directors on corporate governance matters.

Compensation Committee Interlocks and Insider Participation

During 2016,2018, our compensation committee consisted of Mr.Ms. Alber (until the 2018 Annual Meeting), and Messrs. Bromberg, Callaghan Mr.(until our 2018 Annual Meeting), Fluegel, Murray, and Paisley and Ms. Alber (as of June 2016)(until October 2018). None of them has at any time been one of our officers or employees. Moreover, none of our executive officers currently serves, or in the past has served, as a member of the board of directors or compensation committee (or other board committee performing equivalent functions) of any entity that has one or more of its executive officers who served on our board of directors or our compensation committee in 2016.2018.

CodeCodes of Business Conduct and Ethics

Our board of directors has adopted codes of conduct and ethics that apply to all of our employees, officers, and directors. The full text of our codes of conduct and ethics are posted on available in the Investor Relations section of our website. website, which is located at https://investor.fitbit.com by clicking on “Governance.” We intend to disclose future amendments to certain provisions of our codes of conduct and ethics, or waivers of these provisions, on our website or in filings under the Exchange Act.

Board and Committee Meetings and Attendance

Our board of directors and its committees meet throughout the year on a set schedule, and also hold special meetings and act by written consent from time to time. During 2016,2018, our board of directors met eight times and acted by unanimous written consent three times, the audit committee met ten times and did not act by unanimous written consent, the compensation committee met seven times and acted by unanimous written consent one time,nine times, the audit committee met twelve times and acted by unanimous written consent once, the compensation committee met seven times

and acted by unanimous written consent eight times, and the nominating and governance committee met twothree times and acted by unanimous written consent one time.four times. None of the directors attended fewer than 75% of the aggregate of the total number of meetings held by our board of directors and by all committees of our board of directors on which such director served (during the period that such director served on our board of directors and any committee).

Board Attendance at Annual Stockholders’ Meeting

Our policy is to invite and encourage each member of our board of directors to be present at our annual meetings of stockholders. AllFive of our then-currentthen current serving directors were present at our 2016 annual meeting of stockholders.

2018 Annual Meeting.

Presiding Director of Non-Employee Director Meetings

The non-employee directors meet in regularly scheduled executive sessions without management to promote open and honest discussion. Our lead independent director, Mr. Callaghan,Murray, is the presiding director at these meetings.

Communication with Directors

Stockholders and interested parties who wish to communicate with our board of directors, non-management members of our board of directors as a group, a committee of our board of directors, or a specific member of our board of directors (including our Chairman or lead independent director) may do so by letters addressed to the attention of our General Counsel.

All communications are reviewed by our General Counsel and provided to the members of our board of directors consistent with a screening policy providing that unsolicited items, sales materials, abusive, threatening, or otherwise inappropriate materials, and other routine items and items unrelated to the duties and responsibilities of our board of directors not be relayed on to directors. Any communication that is not relayed is recorded in a log and made available to our board of directors.

The address for these communications is:

Fitbit, Inc.

c/o General Counsel

405 Howard199 Fremont Street, 14th Floor

San Francisco, California 94105

NOMINATIONS PROCESS AND DIRECTOR QUALIFICATIONS

Nomination to the Board of Directors

Candidates for nomination to our board of directors are selected by our board of directors based on the recommendation of the nominating and governance committee in accordance with the committee’s charter, our restated certificate of incorporation, andour restated bylaws, our Corporate Governance Guidelines, and the criteria adopted by our board of directors regarding director candidate qualifications. In recommending candidates for nomination, the nominating and governance committee considers candidates recommended by directors, officers, employees, stockholders, and others, using the same criteria to evaluate all candidates. Evaluations of candidates generally involve a review of background materials, internal discussions, and interviews with selected candidates, as appropriateappropriate. In addition, the nominating and in addition, thegovernance committee may engage consultants or third-party search firms to assist in identifying and evaluating potential nominees.

Additional information regarding the process for properly submitting stockholder nominations for candidates for membership on our board of directors is set forth below under “Stockholder Proposals to Bebe Presented at Next Annual Meeting.”

Director Qualifications

With the goal of developing a diverse, experienced, and highly qualified board of directors, the nominating and governance committee is responsible for developing and recommending to our board of directors the desired qualifications, expertise, and characteristics of members of our board of directors, including qualifications that the committee believes must be met by a committee-recommended nominee for membership on our board of directors and specific qualities or skills that the committee believes are necessary for one or more of the members of our board of directors to possess.

Since the identification, evaluation, and selection of qualified directors is a complex and subjective process that requires consideration of many intangible factors, and will be significantly influenced by the particular needs of our board of directors from time to time, our board of directors has not adopted a specific set of minimum qualifications, qualities, or skills that are necessary for a nominee to possess, other than those that are necessary to meet U.S. legal, regulatory, and New York Stock Exchange listing requirements and the provisions of our restated certificate of incorporation, restated bylaws, Corporate Governance Guidelines, and charters of the committees of our board committees.of directors. In addition, neither our board of directors nor our nominating and governance committee has a formal policy with regard to the consideration of diversity in identifying nominees. When considering nominees, our nominating and governance committee may take into consideration many factors including, among other things, a candidate’s independence, integrity, diversity, skills, financial and other expertise, breadth of experience, and knowledge about our business or industry, and ability to devote adequate time and effort to the responsibilities of our board of directors in the context of its existing composition. Through the nomination process, the nominating and governance committee seeks to promote board membership that reflects a diversity of business experience, expertise, viewpoints, personal backgrounds, and other characteristics that are expected to contribute to our board of directors’ overall effectiveness. The brief biographical description of each director set forth in Proposal 1 below includes the primary individual experience, qualifications, attributes, and skills of each of our directors that led to the conclusion that each director should serve as a member of our board of directors at this time.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our board of directors currently consists of seveneight directors. Each of our directors will stand for election at the Annual Meeting and shall serve for a one-year term expiring at our 20182020 annual meeting of stockholders and until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, or removal.

Shares represented by proxies will be voted “FOR” the election of each of the seveneight nominees named below, unless the proxy is marked to withhold authority to so vote. If any nominee for any reason is unable to serve or for good cause will not serve, the proxies may be voted for such substitute nominee as the proxy holder might determine. Each nominee has consented to being named in this Proxy Statement and to serve if elected.

Information Regarding the Board of Directors and Nominees to the Board of Directors

The names of the members of our current board of director and nominees, and their ages and occupations as of AprilMarch 1, 2017,2019, are provided in the table below. Additional biographical descriptions of each nominee are set forth in the text below the table.

|

| | |

| Name of Director/Nominee | Age | Position |

| James Park | 4042 | President, Chief Executive Officer, and Chairman |

| Eric N. Friedman | 3941 | Chief Technology Officer and Director |

Laura J. Alber(2) | 50 | Director |

Matthew Bromberg(1) | 48 | Director |

Jonathan D. Callaghan(1)(2)†

| 4852 | Director |

Glenda Flanagan(3) | 6365 | Director |

Bradley M. Fluegel(1)(2) | 57 | Director |

Steven Murray(2)(1)(3)† | 4850 | Director |

Christopher Paisley(1)(2)(3) | 6466 | Director |

__________________

| |

(1) | Member of the compensation committee. |

| |

(2) | Member of the nominating and governance committee. |

| |

(3) | Member of the audit committee. |

| |

| † | Lead independent director. |

James Park is our co-founder and has served as a member of our board of directors since March 2007, as our Chairman since May 2015, and as our President and Chief Executive Officer since September 2007. Previously, Mr. Park served as a Director of Product Development at CNET Networks, Inc., an online media company. Prior to CNET Networks, Mr. Park served as the President and a co-founder of Wind-Up Labs, Inc., an online photo sharing company acquired by CNET Networks in April 2005. He was also Chief Technology Officer and a co-founder of Epesi Technologies, Inc., a software company. Mr. Park attended Harvard College where he studied computer science. Mr. Park was selected to serve as a member of our board of directors due to the perspective and experience he brings as our co-founder, President, and Chief Executive Officer.

Eric N. Friedman is our co-founder and has served as a member of our board of directors since March 2007 and as an executive officer since September 2007, including most recently as our Chief Technology Officer. Previously, Mr. Friedman served as an engineer manager at CNET Networks. Prior to CNET Networks, Mr. Friedman served as a co-founder of Wind-Up Labs, a founding engineer of Epesi Technologies, and a technical member of the Real-Time Collaboration Group at Microsoft Corporation. Mr. Friedman holds a B.S. and an M.S. in computer science from Yale University. Mr. Friedman was selected to serve as a member of our board of directors due to the perspective and experience he brings as our co-founder and Chief Technology Officer.

Laura J. Alber has served as a member of our board of directors since June 2016. Ms. Alber has served as the Chief Executive Officer of Williams-Sonoma, Inc., a retail company of kitchen and home products, since May 2010 and as President of Williams-Sonoma since July 2006. Ms. Alber joined Williams-Sonoma in 1995 as a Senior Buyer for Pottery Barn. Ms. Alber has held numerous brand management roles within the company, including the positions of President, Pottery Barn Brands; Executive Vice President, Pottery Barn Merchandising; and Senior Vice President, Pottery Barn Catalog and Pottery Barn Kids Retail. Prior to Williams-Sonoma, Ms. Alber worked at The Gap, Inc. and Contempo Casuals, and was a small business owner. Ms. Alber holds a B.A. in psychology from the University of Pennsylvania. Ms. Alber was selected to serve as a member of our board of directors due to her extensive retail industry, merchandising, and operational experience.

Jonathan D. CallaghanMatthew Bromberg has served as a member of our board of directors since September 2008.March 2018. Mr. Callaghan is a founder andBromberg has served as Chief Operating Officer of Zynga Inc., a Managing Member of True Ventures, a venture capital firm,social game developer, since January 2006.August 2016. Prior to True Ventures,joining Zynga, Mr. CallaghanBromberg worked at Electronic Arts Inc., a video game company, where he served as Senior Vice President of Strategy and Operations of the mobile division from January 2015 to July 2016, Group General Manager of Bioware from September 2013 to December 2014 and General Manager of Bioware Austin from May 2012 to September 2013. Prior to joining Electronic Arts, Mr. Bromberg was the founder and Chief Executive Officer of I’mOK Inc., a Managing Director at Globespan Capital, a venture capital firm, and as a Managing Partner at CMGI@Ventures, CMGI Inc.’s affiliated venture capital group.location-based communication platform for families, from March 2011 to March 2012. Prior to this, Mr. Callaghan worked forBromberg served as the President and Chief Executive Officer of Major League Gaming Corp., a professional eSports company, from 2006 to 2010, Chief Executive Officer of Davidson Media Holdings, LLC, an online gaming investment and consulting partnership, from 2005 to 2006, and held a number of senior roles at AOL Inc.’s Greenhouse, the venture capital/incubator for AOL, (now a subsidiary of Verizon Communications Inc.) from 1999 to 2005. Mr. Bromberg holds a B.A. in english from Cornell University and as an associate at Summit Partners. Mr. Callaghan holds an A.B. in government from Dartmouth College and an M.B.A.a J.D. from Harvard BusinessLaw School. Mr. CallaghanBromberg was selected to serve as a member of our board of directors due to his extensive experience with technology companies.companies and his operational experience.

Glenda Flanagan has served as a member of our board of directors since June 2016. Ms. Flanagan has served as the Executive Vice President and Chief Financial Officer of Whole Foods Market, Inc., a supermarket chain, since 1988.from 1988 through May 2017, when she became the Executive Vice President and Senior Advisor. Ms. Flanagan currently serves on the boards of directors of Whole Planet Foundation, Whole Cities Foundation, and Whole Kids Foundation, as well as the public company Credit Acceptance Corporation. Ms. Flanagan holds a B.B.A. in accounting from the University of Texas at Austin. Ms. Flanagan was selected to serve as a member of our board of directors due to her extensive experience with leading consumer and health-related brand, and expertise and background with regard to accounting and financial matters.

Bradley Fluegel has served as a member of our board of directors since March 2018. Mr. Fluegel served as Senior Vice President, Chief Healthcare Commercial Market Development Officer of Walgreen Co., a retail-pharmacy store chain, from October 2015 to January 2018. Mr. Fluegel joined Walgreen in October 2012 as Senior Vice President, Chief Strategy and Business Development Officer after previously serving as Executive in Residence at Health Evolution Partners, a healthcare private equity firm, from April 2011 to September 2012. Prior to joining Health Evolution Partners, Mr. Fluegel served as Executive Vice President and Chief Strategy and External Affairs Officer of Wellpoint, Inc. (now Anthem, Inc.), a health care benefits company, from September 2007 to December 2010. Prior to that, Mr. Fluegel served as Senior Vice President of National Accounts and Vice President, Enterprise Strategy at Aetna Inc., a health care benefits company, from 2005 to 2007. Prior to this, Mr. Fluegel served as Chief Executive Officer for Reden & Anders, Ltd. (now part of Optum), a provider of consulting services for the health care industry, from 2002 to 2005, and served in various positions at Tillinghast-Towers Perrin, a clinical, actuarial and management consulting practice serving the health care industry, from 1995 to 2002. Mr. Fluegel holds a B.A. in business administration from the University of Washington and a Masters in Public Policy from Harvard University. Mr. Fluegel currently serves on the board of directors of Performant Financial Corporation and has also served on the board of directors for a number of private companies. He also is a lecturer at the University of Pennsylvania’s Wharton School of Business. Mr. Fluegel was selected to serve as a member of our board of directors due to his extensive commercial healthcare industry and operational experience.

Steven Murray has served as a member of our board of directors since June 2013. Mr. Murray is a Partner at Revolution Growth, a venture capital firm, where he has worked since January 2016. From April 1996 to January 2016, Mr. Murray worked at SoftBank Capital, a venture capital firm, where he most recently served as a Partner. Prior to this, Mr. Murray worked for Deloitte & Touche LLP, where he specialized in serving high growth technology based businesses. Mr. Murray also serves on the board of directors for a number of private companies. Mr. Murray holds a B.S. in accounting from Boston College. Mr. Murray was selected to serve as a member of our board of directors due to his extensive experience with technology companies.

Christopher Paisley has served as a member of our board of directors since January 2015. Mr. Paisley has served as the Dean’s Executive Professor of Accounting at the Leavey School of Business at Santa Clara University since January 2001. Prior to this, Mr. Paisley served as Senior Vice President of Finance and Chief Financial Officer for 3Com Corporation, a computer networking manufacturer. Mr. Paisley currently serves on the boards of directors of Ambarella, Inc., Equinix, Inc., Fortinet, Inc., and YuMe,Fortinet, Inc. He also previously served as a director of Bridge Capital Holdings, Control4 Corporation, and Volterra Semiconductor Corporation.YuMe, Inc. Mr. Paisley holds a B.A. in business economics from the University of California, Santa Barbara and an M.B.A. from the UCLA Anderson School of Management. Mr. Paisley was selected to serve as a member of our board of directors due to his extensive board and operational experience.

There are no familial relationships among our directors and executive officers.

Director Compensation

The following table provides information for 20162018 concerning all compensation awarded to, earned by, or paid to each person who served as a non-employee director for some portion of 2016.2018. James Park, our President and Chief Executive Officer, and Eric N. Friedman, our Chief Technology Officer, are not included in the table below because they did not receive additional compensation for their services as directors. Total compensation for Messrs. Park and Friedman for services as employees is presented in “Executive Compensation—Summary Compensation Table” below.

|

| | | |

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | Total ($) |

Laura Alber(2) | 33,552 | 166,938 | 200,490 |

Jonathan D. Callaghan(3) | — | — | — |

Glenda Flanagan(4) | 36,598 | 166,938 | 203,536 |

Steven Murray(5) | 67,516 | 162,019 | 229,535 |

Christopher Paisley(6) | 76,518 | 162,019 | 238,537 |

|

| | | |

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | Total ($) |

Laura J. Alber(2) | 56,680 | 179,750 | 236,430 |

Matthew Bromberg(3) | 45,803 | 214,302 | 260,105 |

Glenda Flanagan(4) | 65,582 | 179,750 | 245,332 |

Bradley Fluegel(5) | 72,111 | 216,647 | 288,758 |

Steven Murray(6) | 89,787 | 179,750 | 269,537 |

Christopher Paisley(7) | 82,500 | 179,750 | 262,250 |

__________________________

| |

(1) | The amounts reported in this column represent the aggregate grant date value of restricted stock unit, or RSU, awards made to directors in 20162018 computed in accordance with Financial Accounting Standard Board Accounting Standards Codification Topic 718, Compensation — Stock Compensation, or “FASB ASC Topic 718.” This amount does not reflect the actual economic value realized by the director, which will vary depending on the performance of our Class A common stock. |

| |

(2) | As of December 31, 2016,2018, Ms. Alber held 11,505 RSUs. The RSUs vest in accordance with the vesting schedule described below under “—Non-Employee Director Compensation Arrangements—Non-Employee Director Equity Compensation—Initial Equity Grant.” |

| |

(3)

| Mr. Callaghan has waived any right to receive compensation that he may be entitled to receive for service as a non-employee director. |

| |

(4)

| As of December 31, 2016, Ms. Flanagan held 11,505 RSUs. The RSUs vest in accordance with the vesting schedule described below under “—Non-Employee Director Compensation Arrangements—Non-Employee Director Equity Compensation—Initial Equity Grant.” |

| |

(5)

| As of December 31, 2016, Mr. Murray held 11,44234,238 RSUs. The RSUs vest in accordance with the vesting schedule described below under “—Non-Employee Director Compensation Arrangements—Non-Employee Director Equity Compensation—Annual Equity Grant.” |

| |

(6)(3)

| As of December 31, 2016,2018, Mr. Bromberg held 34,238 RSUs. The RSUs vest in accordance with the vesting schedule described below under “—Non-Employee Director Compensation Arrangements—Non-Employee Director Equity Compensation—Annual Equity Grant.” |

| |

(4) | As of December 31, 2018, Ms. Flanagan held 34,238 RSUs. The RSUs vest in accordance with the vesting schedule described below under “—Non-Employee Director Compensation Arrangements—Non-Employee Director Equity Compensation—Annual Equity Grant.” |

| |

(5) | As of December 31, 2018, Mr. Fluegel held 34,238 RSUs. The RSUs vest in accordance with the vesting schedule described below under “—Non-Employee Director Compensation Arrangements—Non-Employee Director Equity Compensation—Annual Equity Grant.” |

| |

(6) | As of December 31, 2018, Mr. Murray held 34,238 RSUs. The RSUs vest in accordance with the vesting schedule described below under “—Non-Employee Director Compensation Arrangements—Non-Employee Director Equity Compensation—Annual Equity Grant.” |

| |

(7) | As of December 31, 2018, Mr. Paisley held 11,44234,238 RSUs and ana stock option to purchase 60,000 shares of Class B common stock. The RSUs vest in accordance with the vesting schedule described below under “—Non-Employee Director Compensation Arrangements—Non-Employee Director Equity Compensation—Annual Equity Grant.” 1/24th of the shares subject to the option vested on February 29, 2015, and the remaining shares subject to the option vest at a rate of 1/24th of the total shares subject to the option on each month thereafter, subject to continued service to us through each vesting date. |

Arrangements—Non-Employee Director Equity Compensation—Annual Equity Grant.” The shares subject to the stock option fully vested on January 29, 2017.

Non-Employee Director Compensation Arrangements

Non-Employee Director Equity Compensation

Initial Equity Grant. Each non-employee director appointed to our board of directors is automatically granted an initial grant of RSUs on the date of his or her appointment to our board of directors having an aggregate fair market value of $175,000 (with such amount pro-rated based on the number of days between the date of such director’s appointment and the date of our first annual meeting of stockholders following the date of grant (or to the extent that we have not determined the date of the next annual meeting of stockholders on or before the date of grant, May 15 following the date of grant)). The RSUs will fully vest on the date of our first annual meeting of stockholders following the date of grant or immediately prior to the consummation of a change of control event. If an individual is appointed as a non-employee director at an annual meeting of stockholders, he or she will be granted an annual equity grant, as described below, in lieu of the initial equity grant.

Annual Equity Grant. On the date of each annual meeting of stockholders, each non-employee director who is serving on our board of directors on the date of such annual meeting will be automatically granted RSUs having an aggregate fair market value of $175,000. The RSUs will fully vest on the earlier of (i) the date of the following year’s annual meeting of stockholders (but only for a non-employee director who does not stand for re-election at, or is not re-elected at, the following year’s annual meeting of stockholders but who otherwise serves on the board of directors until the date of such meeting) and (ii) the date that is one year following the date of grant.

Non-Employee Director Cash Compensation

Each non-employee director is also entitled to receive an annual cash retainer of $50,000 for service on the board of directors and additional annual cash compensation for the lead independent director and committee membership as follows:

Lead independent director: $20,000

Audit committee member: $10,000

Audit committee chair: $25,000

Compensation committee member: $7,500

Compensation committee chair: $17,500

Lead independent director: $20,000

Nominating and governance committee member: $5,000

Nominating and governance committee chair: $12,500

OUR BOARD OF DIRECTORS RECOMMENDS

A VOTE “FOR” ELECTION OF EACH OF THE SEVENEIGHT NOMINATED DIRECTORS

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our audit committee has selected PricewaterhouseCoopersGrant Thornton LLP, or Grant Thornton, as our independent registered public accounting firm to perform the audit of our financial statements for the fiscal year ending December 31, 20172019 and recommends that stockholders vote for ratification of such selection. The ratification of the selection of PricewaterhouseCoopers LLPGrant Thornton as our independent registered public accounting firm for the fiscal year ending December 31, 20172019 will be determined by the vote of a majority of the voting power of the shares present or represented at the Annual Meeting and voting affirmatively or negatively on the proposal. In the event that PricewaterhouseCoopers LLPGrant Thornton is not ratified by our stockholders, the audit committee will review its future selection of PricewaterhouseCoopers LLPGrant Thornton as our independent registered public accounting firm.

PricewaterhouseCoopers LLP audited our financial statements for 2016. Representatives of PricewaterhouseCoopers LLPGrant Thornton are expected to be present at the Annual Meeting, in which case they will be given an opportunity to make a statement at the Annual Meeting if they desire to do so and will be available to respond to appropriate questions.

Change of Independent Registered Public Accounting Firm

On March 8, 2019, we, following an evaluation of audit fees and costs and at the direction of our audit committee, chose not to renew the engagement of PricewaterhouseCoopers LLP, or (“PwC”), which was then serving as the company’s independent registered public accounting firm. We notified PwC on March 9, 2019 that it would be dismissed as our independent registered public accounting firm, effective immediately. The decision to change independent registered public accounting firms was approved by the audit committee.

PwC’s reports on the company’s consolidated financial statements as of and for the fiscal years ended December 31, 2018 and 2017 did not contain any adverse opinion or a disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope, or accounting principles.

During our two most recent fiscal years ended December 31, 2018 and 2017 and the subsequent interim period through March 9, 2019, there were no disagreements, within the meaning of Item 304(a)(1)(iv) of Regulation S-K promulgated under the Exchange Act, or “Regulation S-K”, and the related instructions thereto, with PwC on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of PwC, would have caused it to make reference to the subject matter of the disagreements in connection with its reports. Also during this same period, there were no reportable events within the meaning of Item 304(a)(1)(v) of Regulation S-K and the related instructions thereto, except for the material weakness in our internal control over financial reporting related to the accuracy of the inputs in the sales order entry process, previously reported in Item 9A of our Annual Report on Form 10-K for the fiscal years ended December 31, 2018 and December 31, 2017, which has not yet been fully remediated.

On March 8, 2019, the audit committee approved the appointment of Grant Thornton as the company’s new independent registered public accounting firm, effective upon dismissal of PwC on March 9, 2019. During our two most recent fiscal years ended December 31, 2018 and 2017, and the subsequent interim period through March 9, 2019, neither we nor anyone acting on its behalf consulted with Grant Thornton regarding any of the matters described in Items 304(a)(2)(i) and (ii) of Regulation S-K.

Independent Registered Public Accounting Firm Fees and Services

We regularly review the services and fees from our independent registered public accounting firm. These services and fees are also reviewed with our audit committee annually. In accordance with standard policy, PricewaterhouseCoopers LLPGrant Thornton will periodically rotatesrotate the individuals who are responsible for our audit.

In addition to performing the audit of our consolidated financial statements, PricewaterhouseCoopers LLPPwC provided various other services during 20152017 and 2016.2018. During 20152017 and 2016,2018, fees for services provided by PricewaterhouseCoopers LLPPwC were as follows:

|

| | | | | | |

| | 2015 | 2016 |

Audit fees(1) | $ | 3,552,760 |

| $ | 2,944,650 |

|

Audit-related fees(2) | 25,000 |

| 97,500 |

|

Tax fees(3) | 918,635 |

| 679,851 |

|

All other fees(4) | 3,906 |

| 88,600 |

|

| Total fees | $ | 4,500,301 |

| $ | 3,810,601 |

|

|

| | | | | | |

| | 2017 | 2018 |

Audit fees(1) | $ | 4,344,419 |

| $ | 4,443,540 |

|

Audit-related fees(2) | 242,398 |

| — |

|

Tax fees(3) | 813,649 |

| 996,707 |

|

All other fees(4) | 3,600 |

| 1,800 |

|

| Total fees | $ | 5,404,066 |

| $ | 5,442,047 |

|

| |

(1) | Includes fees for audit services primarily related to the audit of our annual financial statements; the review of our quarterly financial statements; comfort letters, consents, and assistance with and review of documents filed with the SEC, including our registration statements on Form S-1 related to our initial public offering in June 2015 and our follow-on offering in November 2015;SEC; and other accounting and financial reporting consultation and research work billed as audit fees or necessary to comply with the standards of the Public Company Accounting Oversight Board. The amount for 2015 also includes $340,000 previously not reported and billed after the filing of our Definitive Proxy Statement, filed on April 13, 2016. We are still in discussions with PricewaterhouseCoopers LLP regarding the final amount of fees to be paid for such services for the year ended December 31, 2016, so the amounts disclosed for that year, which are based on our pre-approved budget for audit fees, are subject to changebased on the outcome of those discussions. |

| |

(2) | Includes fees for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements including in connection with acquisitions by us of other companies in 20152017 and 2016.2018. |

| |

(3) | Includes fees for tax compliance, advice, and planning. Tax advice fees encompass a variety of permissible tax services, including technical tax advice related to federal and state and international income tax matters; transfer pricing, international tax structure planning, and assistance with indirect sales tax; and assistance with tax audits. |

| |

(4) | Includes fees for services other than the services reported in audit fees, audit-related fees, and tax fees. |

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

Our audit committee’s policy is to pre-approve all audit and permissible non-audit services provided by the independent registered public accounting firm. These services may include audit services, audit-related services, tax services, and other services. Pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. The independent registered public accounting firm and management are required to report periodically to the audit committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date.

All of the services relating to the fees described in the table above were pre-approved by our audit committee.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF PROPOSAL NO. 2

PROPOSAL NO. 3

ADVISORY VOTE ON EXECUTIVE COMPENSATION

APPROVAL OF STOCK OPTION EXCHANGE PROGRAM FOR ELIGIBLE EMPLOYEES (INCLUDING CERTAIN OF OUR EXECUTIVE OFFICERS)

Introduction

WeIn accordance with the rules of the SEC, we are seeking stockholder approvalproviding stockholders with an opportunity to make a non-binding, advisory vote on the Compensation Program for our named executive officers. This non-binding advisory vote is commonly referred to as a “say on pay” vote. The non-binding advisory vote on the Compensation Program for our named executive officers, as disclosed in this proxy statement, will be determined by the vote of a proposed stock option exchange program,majority of the voting power of the shares present or represented at the Program, that, if implemented, would allow Eligible Employees (as defined below), includingAnnual Meeting and voting affirmatively or negatively on the proposal.

Stockholders are urged to read the “Executive Compensation” section of this Proxy Statement, which discusses how our executive officers other thancompensation policies and procedures implement our President, Chief Executive Officer,compensation philosophy and Chairman, Chief Technology Officer,contains tabular information and Chief Financial Officer, to exchange out-of-the-money or “underwater” options to purchase sharesnarrative discussion about the compensation of our Class A common stock or Class B common stock currently held by such Eligible Employees for a lesser number of RSUs that may be settled for shares of our Class A common stock, or New RSUs, under our 2015 Plan. Each New RSU will represent an unfunded right to receive one share of our Class A common stock on a date innamed executive officers. The compensation committee and the future, which generally is the date on which the New RSU will vest. The New RSUs will be granted on the Exchange Date (as defined below), which we currently anticipate will occur immediately following the expiration of the Exchange Offer (as defined below). The New RSUs will generally vest over the remaining vesting period of the applicable Eligible Option (as defined below) (subject to a one-year minimum vesting period). None of the members of our board of directors would be eligible to participatebelieve that these policies and procedures are effective in the Program.

Approval of the Program will enable us to leverage underwater outstanding stock options, for the purposes for which they were originally intended, namely, to motivate and retainimplementing our employees. In addition, the Program will allow us to reduce our equity award “overhang” (that is, the number of shares subject to outstanding equity awards relative to the total number of shares of our Class A or Class B common stock outstanding) through the cancellation of outstanding stock options that currently provide no meaningful retention or incentive value to our employees.

Overview

If the Proposal 3 is approved, Eligible Employees, including our executive officers other than the executive officers listed below, will have the opportunity to surrender Eligible Optionsand will receive in exchange one New RSU for every two shares subject to Eligible Options that are surrendered. The ineligible executive officers are as follows:

James Park, our President, Chief Executive Officer, and Chairman;

Eric N. Friedman, our Chief Technology Officer; and

William Zerella, our Chief Financial Officer.

In addition, none of the members of our board of directors are eligible to participate in the Program.

As of February 28, 2017, there were a total of 1,220,916 shares of Class A common stock and a total of 31,837,688 shares of Class B common stock subject to outstanding stock options. Of the outstanding stock options, as of that date and assuming the Assumed Exchange Date Price (as defined below), options to purchase 697,916 shares of Class A common stock and options to purchase 5,402,179 shares of Class B common stock, at a weighted average exercise price of $10.85 per share and a weighted average remaining life of 7.46 years, would be underwater and eligible for exchange under the proposed Program. We refer herein to the closing price of our Class A common stock on the New York Stock Exchange on February 28, 2017 of $6.21, which we assume for purposes of an example only throughout this Proposal 3 to be the closing price of our common stock on the Exchange Date, as the “Assumed Exchange Date Price.” Assuming full participation in the Program by Eligible Employees, up to 3,049,980 New RSUs would be issued and 6,100,095 shares of Class A common stock would be cancelled, resulting in 3,050,115 shares becoming available

for future issuance under our 2015 Plan. If the closing price of our Class A common stock was below the Assumed Exchange Date Price on the Exchange Date, additional shares subject to outstanding stock options would be eligible for exchange under the Program as follows:

|

| | | | | | | | |

| Exercise Price of Eligible Options | Outstanding Eligible Options | Weighted Average Exercise Price of Eligible Options | Weighted Average Remaining Life of Eligible Options (Years) | Maximum Number of Replacement RSUs |

| <$2.30 | 9,548,915 |

| $ | 0.85 |

| 5.61 | 4,774,429 |

|

| $3.63 | 4,136,917 |

| $ | 3.63 |

| 7.34 | 2,068,447 |

|

| $4.52 | 870,795 |

| $ | 4.52 |

| 6.7 | 435,389 |

|

| Total | 14,556,627 |

| $ | 1.49 |

| 6.16 | 7,278,265 |

|

Notwithstanding the foregoing, since the number of Eligible Employees and Eligible Options will not be known until the Program is completed, we are unable to determine at this time the exact number of New RSUs that may be granted in connection with the Program. All Eligible Options that are not exchanged will remain outstandingcompensation philosophy and in effect in accordance with their existing terms. We currently anticipateachieving our goals. Accordingly, we ask our stockholders to vote “FOR” the following resolution at the Annual Meeting:

“RESOLVED, that the surrendered stock options will be cancelled on the first business date after the expiration of the Exchange Offer. Such date is referred to herein as the “Exchange Date.” We expect the New RSUs will be granted under the 2015 Plan on the Exchange Date. The shares of our common stock subject to surrendered stock options will become available for future issuance as Class A common stock under our 2015 Plan once the surrendered stock options are cancelled.

Reasons for the Program

Since our initial public offering in June 2015, the market price of our Class A common stock has fluctuated significantly. Our Class A common stock traded for more than $47.00 a share in July 2015, but in recent times has traded for significantly less. The closing price of our Class A common stock on the New York Stock Exchange on February 28, 2017 was $6.21 per share. As a result, a significant number of the stock options granted to our employees at higher valuations have lost their economic benefit to these employees, eroding their effectiveness as an economic incentive to stay with the company while nevertheless creating potential dilution to our stockholders. Additionally, under applicable accounting rules, we are required to continue to recognize compensation expense related to these underwater stock options as they vest, even if they are never exercised because they remain underwater and do not fully provide the intended incentive and retention benefits. We believe that that the Program will allow us to recapture retentive and incentive value from the compensation expense that we record in our financial statements with respect to certain Eligible Options. By replacing underwater options that have diminished retention or incentive value with New RSUs that will provide both enhanced retention and incentive value while incurring only incremental compensation expense, we will be able to use our resources more efficiently.

As of February 28, 2017, approximately 18.5% of our outstanding stock options and 28.8% of our unvested outstanding stock options had exercise prices that are equal to or greater than the Assumed Exchange Date Price. In addition, as of February 28, 2017, of employees who held one or more stock options, approximately 47.2% held stock options with exercise prices that were equal to or greater than the Assumed Exchange Date Price. This means that a significant number of our stock options fail to provide the incentive and retention benefits they were designed to provide, as they are perceived to have little or no economic value to these employees. Accordingly, our management, board of directors, and compensation committee have concluded that we could be at risk of losing key talent.

Beginning in January 2017, our compensation committee engaged Compensia, an independent compensation consultant, to perform a comprehensive evaluation of a stock option exchange program. As part of this evaluation, our compensation committee identified the likely participants of an exchange program, and evaluated the value of the equity awards to be exchanged, the general parameters of an

exchange program, and the effects of an exchange program on our current hiring and retention goals. We determined that an exchange program pursuant to which employees including our executive officers, other than our President, Chief Executive Officer, and Chairman, Chief Technology Officer, and Chief Financial Officer, could exchange their underwater stock options for a lesser number of RSUs was most attractive alternative for several reasons, including the following:

| |